For years when clients asked me where they should leave their cash (possibly for their Emergency Fund or upcoming expenses) the answer was always the same

Do you regularly donate to organizations such as a religious institution, alma mater, or a 501(c)(3) charity? Good for you!

Do you own investments

Salespeople often use “FOMO” or fear of missing out as a strategy to get someone to sign on the dotted line. Not much is at stake when they’re trying to sell

As a Certified Financial Planner ™ people often hire me because they have a vague sense that they should be doing something about their finances, but they’re

I often recommend bond ladders for clients. This Kiplinger article explains how ETFs can be used in creating bond ladders. I'm even quoted toward the end of

Socially Responsible Investing is often shortened to “SRI” or more recently “ESG”. The “E” in ESG stands for Environment, the “S” stands for Social, and the

I'm always on the lookout for resources that help me advise my clients, or that clients can use to help themselves. I recently came across this interesting

We all love Roth IRAs. What’s not to love? Instead of putting excess income into a brokerage account that has its dividends and income taxed each year, as

For anyone who finds themselves 5-10 years away from retirement, I'd have to recommend this book.

Its worksheets take you step-by-step through such topics

I love this book! I think that everyone who's close to retirement, or in retirement, will benefit from reading this book. You can read it all the way

I just listened to "The Investment Answer" by Daniel C. Goldie and Gordon S. Murray, which was recommended by a client. (Thanks, Mike!) I believe their views on

We all spend money. But do we do so wisely, so as to maximize the happiness it can bring to us? "Happy Money" by Dunn and Norton discusses the links

This is my go-to book for anyone who wants to take charge of their finances. It's straight-forward, easy to read, and very upbeat. Although I don't share

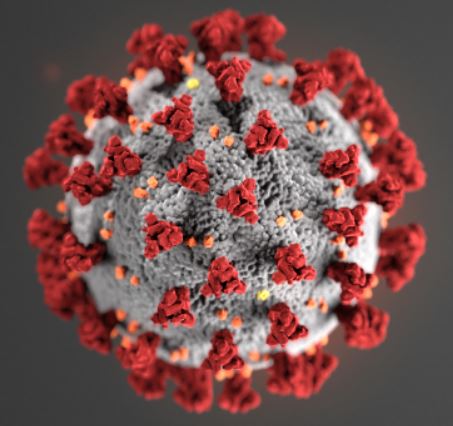

A client recently emailed asking me if, given the recent market downturn, we should rebalance his portfolio. Since I’m sure there are others wondering the

If you want to understand why I believe the best way to invest is to create a low-cost portfolio made up of well-run index funds with a good track record

Here's the link to the Forbes article that was just updated and lists hourly planners throughout the country. Guess who once again made the list!![]()

Many of my clients know how much my husband and I love to explore the world through travel. Since we are both able to work remotely, we're able to get away